InfoFi Revolution: Complete Guide to Kaito, Cookie.fun and New Alpha Opportunities in 2025

In the rapidly evolving Web3 ecosystem, a revolution centered on information monetization is quietly unfolding. InfoFi (Information Finance) is redefining how we value, trade, and monetize information assets. This guide explores the core mechanics of InfoFi, leading platforms like Kaito and Cookie.fun, and reveals how retail investors can find genuine alpha opportunities in this emerging sector.

The Essence of InfoFi: When Information Becomes a Tradable Asset

InfoFi transforms traditionally difficult-to-quantify non-price information—project attention, social reputation, and opinion trends—into priceable, tradable financial assets. Unlike traditional finance, InfoFi doesn't trade Bitcoin or Ethereum, but rather "attention," "reputation," and "possibility"—intangible assets once considered impossible to measure precisely.

This concept's rise isn't coincidental but driven by three core factors:

AI Technology Enablement: Advances in large language models have made it possible to capture, analyze, and evaluate sentiment from massive social data, establishing the technical foundation for information quantification and pricing

Market's Continuous Pursuit of Alpha: Crypto markets constantly seek new growth points and leading indicators

"Attention Precedes Price" Market Law: In the current cycle, surging project popularity often precedes price movements—InfoFi attempts to make these "leading indicators" visible and tradable

InfoFi Ecosystem Landscape: From Attention Capture to Value Realization

The InfoFi ecosystem has evolved into a diverse project matrix, each with unique features yet interconnected. Here are the most representative current projects:

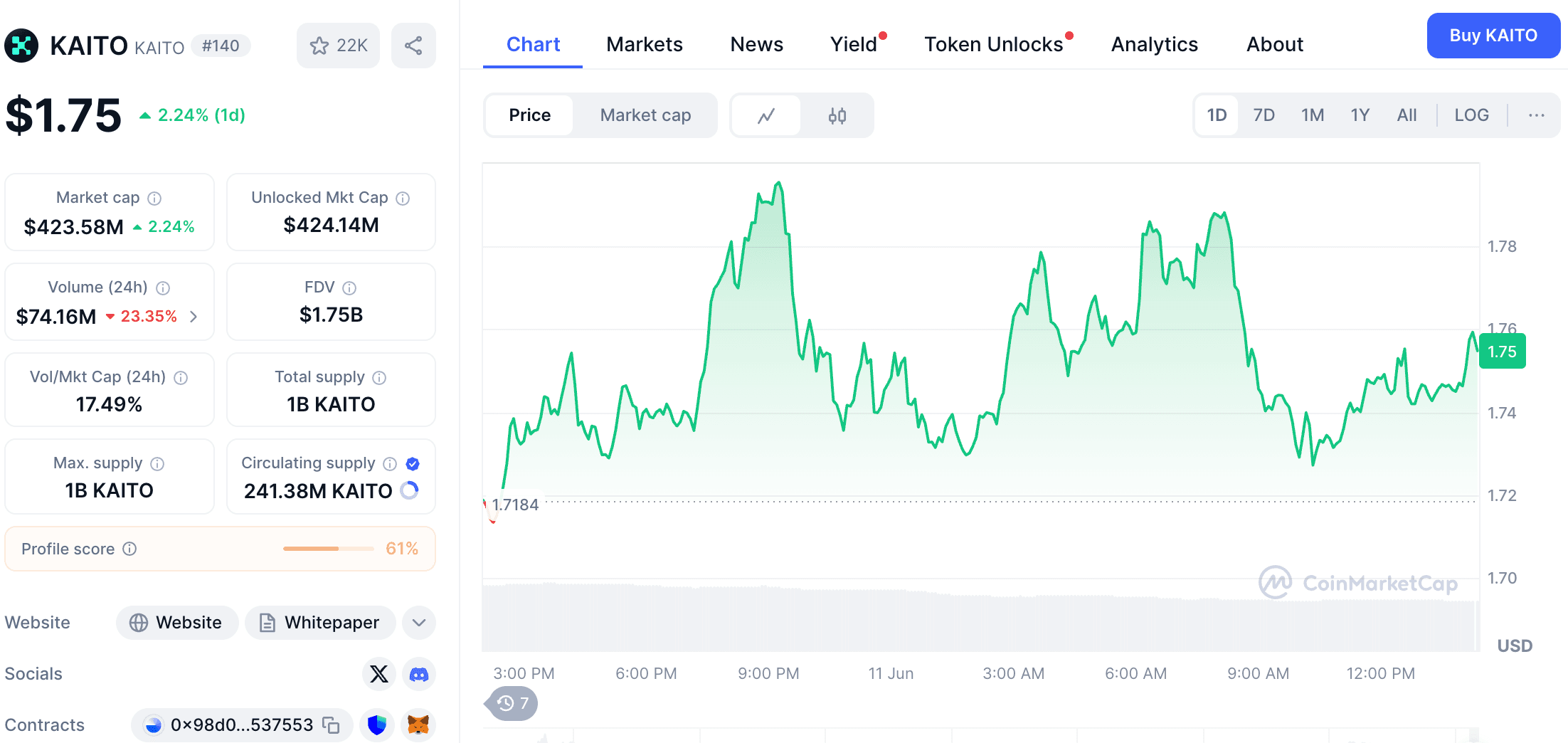

Kaito AI: The Pioneer of InfoFi

Core Mechanism: Uses AI to quantify attention, creating the Yaps point system and Leaderboard rankings

Participation Method: Connect your X account, link your wallet, publish high-quality original content, and interact with high-reputation accounts. Those in the top 1000 of the Leaderboard typically enjoy priority token allocation rights for partner projects.

As the first platform to systematize the retail "talk-to-earn" model, Kaito has become the absolute leader in the InfoFi sector. Its algorithm evaluates not just content quantity but also quality, interactivity, and distribution breadth.

Cookie.fun: An InfoFi Platform Emphasizing Openness

Initially tracking AI-related token information, Cookie.fun has expanded to comprehensive InfoFi services, particularly with its Cookie Snaps feature, which incentivizes high-quality Twitter content. Compared to Kaito, Cookie.fun's algorithm is more open, with evaluation dimensions including mindshare, market sentiment, and price trends.

Noise.xyz: An Attention Share Trading Protocol

Allows users to speculate directly on project attention trends rather than tokens themselves, supporting up to 5x leverage based on real-time data flows from third-party oracles. This represents an important development direction for InfoFi—making "attention" itself a directly tradable derivative.

Ethos Network: The "Yelp of Web3"

Focused on on-chain reputation assessment, Ethos implements a comprehensive review, endorsement, and rating mechanism for projects and individuals. Its innovation lies in the reputation market (Ethos Market), where users can buy and sell "trust tickets" and "distrust tickets" linked to specific profiles, speculating on various reputations and affecting real-time scores.

InfoFi Projects' Token Performance: Can Mindshare Convert to Market Buying Power?

From Huma Finance (HUMA), LOUD, and Story (IP) to Berachain (BERA), Wayfinder (PROMPT), and Initia (INIT), numerous projects have leveraged InfoFi platforms for promotion and token distribution. Analyzing these projects reveals several key trends:

Social Peaks Highly Coincide with Token Issuance: Almost all projects experienced absolute peaks in social media discussion during token issuance, listing, and airdrop periods

Significant Price Volatility: Most projects experienced sharp fluctuations in their early listing period, such as LOUD dropping 25.28% within 24 hours of launch

Social Heat Doesn't Always Correlate with Long-term Value: While InfoFi can effectively enhance a project's short-term visibility, it doesn't guarantee sustained market buying power

This suggests that while InfoFi platforms successfully create social volume, converting "attention" into sustained market cap support remains challenging.

Five Gold-Mining Paths for Retail Participation in InfoFi

For ordinary investors, InfoFi offers diverse participation methods and investment strategies:

1. Content Creation (Write-to-earn)

If you excel at content creation and are diligent, you can earn point rewards by publishing quality content through platforms like Kaito and Cookie.fun. This is a relatively sustainable income method, but beware of platform rule changes and algorithm adjustments.

Tips: Focus on specific areas to establish a professional image; study platform algorithm preferences; consistently produce original views rather than simple reposts.

2. Direct Trading

Participate directly in "information asset" trading on platforms like Noise.xyz or Ethos, profiting from accurate judgments of project heat and market trends.

Advantages: Fast response; high capital utilization efficiency; precise betting on specific events.

3. Decision Support

Use InfoFi platform data as an investment dashboard to assist traditional token investment decisions. For example, use Kaito's search heat and Ethos's reputation scores as references for project screening and timing decisions.

Key: Combine InfoFi data with fundamental analysis and technical analysis to avoid single-dimension decision-making.

4. Project Investment

Research the InfoFi track itself and select promising platform tokens for medium to long-term investment. Pay attention to team background, technical strength, community activity, and token economics.

Screening Indicators: User growth rate; data reliability; revenue model; token deflationary mechanism; investor background.

5. Interactive Participation

Closely monitor emerging InfoFi project dynamics and actively participate in testnets, community activities, and content contributions to qualify for early airdrops. This is an effective low-cost entry method.

Deep Challenges and Future Trends of InfoFi

While InfoFi pioneered a new paradigm of information valuation, it also faces several key challenges:

1. Content Homogenization and Quality Dilution

Platform algorithms struggle to precisely identify content quality, rewarding only easily quantifiable metrics (posting frequency, interaction volume, etc.), resulting in widespread "point-farming" behaviors that drown quality content in low-quality material.

2. Divergence Between Platform Algorithms and Real Value

As @Bruce1_1 pointed out, current InfoFi systems have led to serious information entropy increase, where content creators become "algorithm riders" serving the system rather than users.

3. Reputation Manipulation and Rating Fairness

Reputation systems face risks of artificial manipulation, including team hype and coordinated promotion, affecting assessment objectivity.

4. Conversion Efficiency from Attention to Actual Value

As DWF Ventures notes, InfoFi projects' market share assessment cannot rely solely on "attention share" but must consider actual user stickiness and economic value.

InfoFi's Integration Development Directions

In the future, InfoFi may generate powerful synergies with other Web3 domains:

InfoFi + DeFi: On-chain reputation scoring systems like Ethos Network can serve as credit references for DeFi lending, with quality reputations enjoying better lending conditions; DeFi quantitative strategies will use InfoFi platforms' sentiment indices and heat trends as trading signal inputs.

InfoFi + SocialFi: Creator Social Tokens' value will receive more equitable market pricing through InfoFi platforms.

InfoFi + AI: AI agents can enter InfoFi markets as independent participants, conducting information arbitrage and risk hedging.

Conclusion: InfoFi—Dawn of the Information Gold Standard Era

InfoFi represents an important exploration of Web3's redefinition of information value. It's both a financial innovation and a social experiment attempting to answer the fundamental question: "How much are attention, reputation, and information worth?"

For retail investors, InfoFi presents both opportunities and challenges. When participating in this emerging field, maintain independent thinking, avoid blindly following trends, and learn to distinguish between false heat and real value. Only by truly understanding InfoFi's essence can one become a smart "information prospector" rather than "traffic fodder" for algorithms.

In an age of information explosion, the ability to effectively filter, evaluate, and utilize information may be the most valuable investment skill. InfoFi is the marketization and financialization of this ability.

Note: This analysis is for reference only and does not constitute investment advice. The InfoFi field is developing rapidly; please conduct thorough research and assess risks before participating.

You may also like

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…