Ethereum's RWA Dominance: How One Blockchain is Reshaping the Asset Market

The tokenization of real-world assets (RWAs) represents one of blockchain technology's most promising applications. While numerous chains compete in this space, Ethereum has emerged as the undisputed leader. This article examines why Ethereum has become the backbone of the RWA revolution and what it means for the future of finance.

Understanding RWAs: The Bridge Between TradFi and DeFi

Real World Assets in the blockchain context refer to the tokenization of physical and financial assets that exist in the traditional economy - from government bonds to real estate, commodities, and private credit. By representing these assets on-chain, RWAs combine traditional asset value with blockchain efficiency and programmability.

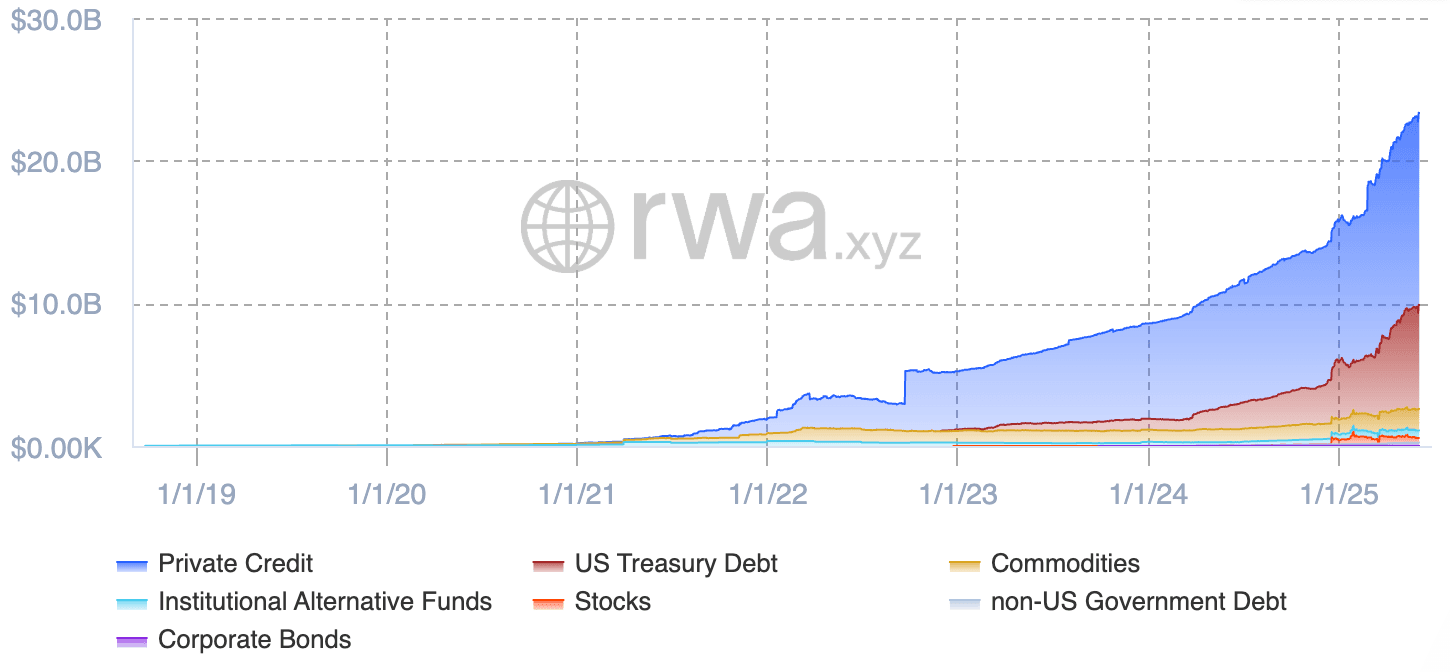

The market for tokenized assets has grown exponentially, with projections suggesting it could expand to $10 trillion by 2030. Currently, Ethereum hosts nearly 60% of all non-stablecoin RWAs, creating a commanding lead in this rapidly growing segment.

Ethereum's RWA Ecosystem: A Data-Driven Analysis

Ethereum's RWA ecosystem shows a distinct concentration in specific asset classes:

| Asset Class | Percentage of Ethereum RWA | Primary Projects |

|---|---|---|

| U.S. Treasury Products | 75.9% | BUIDL, OUSG, USDY |

| Commodities (Gold) | 20.3% | PAXG, XAUT |

| Private Credit | 2.1% | Centrifuge, Goldfinch |

| Real Estate | 1.0% | RealT, Propy |

| Other | 0.7% | Various |

BlackRock's BUIDL fund has become the single most influential project in this ecosystem, reaching $2.7 billion in assets under management with parabolic growth since March 2025. One year ago, it was comparable in size to gold-backed tokens like PAXG and XAUT; today, it significantly outpaces them.

Monthly growth data reveals that Ethereum's RWA expansion began in April 2024 with a 26.6% month-over-month increase. While growth moderated to around 5% monthly through late 2024, 2025 has seen a resurgence, with January posting a 33.2% increase followed by consistent double-digit growth.

Strategic Advantages Driving Ethereum's Leadership

First-Mover Advantage and Institutional Trust

Traditional financial institutions operate on different timelines than DeFi protocols. Regulatory scrutiny, pilot validations, and proof-of-concept demonstrations significantly extend deployment cycles. Ethereum's early establishment of relationships with top financial institutions before the RWA wave gained momentum has positioned it as the default blockchain for institutional deployment.

Ecosystem Maturity and Integration

Ethereum's RWA ecosystem benefits from:

Breadth: Diverse asset issuers and protocol architectures

Depth: Multiple billion-dollar projects creating meaningful scale

DeFi Integration: Direct access to established lending and trading protocols

Recent examples include Ethena using BUIDL as 90% of the reserves for its USDtb stablecoin and numerous DeFi protocols incorporating BUIDL into their collateral systems.

Security and Technical Resilience

Security is foundational for RWA adoption. The May 2025 Cetus protocol exploit on Sui blockchain, resulting in a $223 million loss, demonstrated the risks inherent in newer blockchain infrastructures.

Ethereum's advantages include its battle-tested infrastructure, decentralized architecture, and extensive developer ecosystem. These factors are crucial for institutional confidence in deploying high-value assets on-chain.

The Etherealize Initiative: Strategic Enabler

The Etherealize initiative has emerged as a key force driving Ethereum's RWA adoption. By addressing the gap between protocol development and institutional adoption, Etherealize systematically removes barriers to participation.

The organization's roadmap includes:

Institutional-grade SDKs with compliance workflows and gas optimization

Noir-based enterprise wallet solutions for privacy-preserving transactions

International partnerships with financial hubs in Singapore and Switzerland

Recently, Etherealize founder Vivek Raman testified before the House Financial Services Committee on "The Future of American Innovation and Digital Assets," further strengthening Ethereum's position in regulatory discussions.

Layer-2 Ecosystem: Complementary Growth Vectors

While Ethereum mainnet dominates the RWA landscape, Layer-2 networks provide additional growth avenues:

| Layer-2 Network | Total RWA Value | Top Project | Project Contribution |

|---|---|---|---|

| zkSync | $2.0B | Tradable | $2.0B (100%) |

| Arbitrum | $256M | BENJI | $111.9M (43.7%) |

| Polygon | $210M | Spiko | $73.5M (35.0%) |

| Optimism | $89M | USDe | $40M (44.9%) |

| Base | $45M | Various | Diversified |

Most L2 networks face ecosystem diversity challenges, with RWA values heavily dependent on 1-2 core projects. This concentration creates both opportunities and risks for investors looking at the L2 landscape.

Regulatory Developments: The GENIUS Act's Impact

The GENIUS Act, expected to be voted upon before June 9th, represents both an opportunity and a challenge for the RWA ecosystem. The legislation brings regulatory clarity while imposing significant constraints on stablecoin issuers.

By requiring stablecoin reserves to be anchored to U.S. sovereign credit, the Act effectively ties these assets to American treasuries. This regulatory framework will likely accelerate institutional adoption while potentially reshaping the competitive landscape for existing issuers.

Ethereum's stablecoin ecosystem demonstrates resilience through diversity. Since early 2025, numerous issuers have significantly increased their market capitalization, with new projects emerging and crossing the $50M threshold. This diversity provides natural risk isolation - even if some stablecoins adjust strategies for compliance, others will continue pushing innovation.

Top RWA Projects to Watch in 2025

| Project | Category | Key Features | AUM/TVL |

|---|---|---|---|

| BUIDL by BlackRock | U.S. Treasury | First major asset manager tokenized fund | $2.7B |

| Ondo Finance | U.S. Treasury | OUSG fund, multi-chain capability | $1.0B |

| Maple Finance | Private Credit | Institutional lending, BTC strategies | $300M |

| Propy | Real Estate | Property transactions, title registry | $75M |

| Plume Network | Infrastructure | RWA-focused Layer-1, compliance tools | N/A |

Strategic Implications for Investors

For investors and ecosystem participants, Ethereum's RWA leadership creates several strategic imperatives:

Prioritize Ethereum exposure for RWA investments: The network's dominance, security, and institutional trust make it the primary vehicle for RWA exposure.

Assess L2 opportunities selectively: While Layer-2 networks offer growth potential, evaluate each based on ecosystem diversity rather than headline numbers.

Monitor regulatory developments closely: Legislation like the GENIUS Act will reshape the competitive landscape, creating opportunities for compliant entities.

Consider stablecoin market dynamics: As BIS research indicates, stablecoin issuers have become significant treasury market players, potentially affecting monetary policy transmission.

Conclusion: Ethereum's Pivotal Role in the RWA Revolution

Ethereum's RWA ecosystem has experienced explosive growth in 2025, driven by BUIDL's remarkable expansion and increasing integration between DeFi and traditional finance. This growth demonstrates Ethereum's strategic advantages: first-mover position, security infrastructure, ecosystem depth, and regulatory engagement.

The GENIUS Act is accelerating U.S. credit onboarding into the on-chain world, bringing larger capital volumes and creating new yield opportunities. However, this integration also introduces the fundamental question of Ethereum's positioning - whether to embrace deeper integration with the dollar system or maintain some independence.

As this transformation continues, understanding Ethereum's central role isn't just academic—it's essential for navigating what may become the most significant financial infrastructure shift of the decade. For investors, developers, and financial institutions, Ethereum's leadership in RWA tokenization represents both a strategic opportunity and a glimpse into the future of global finance.

You may also like

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…

SlowMist Unveils Security Vulnerabilities in ClawHub’s AI Ecosystem

Key Takeaways SlowMist identifies 1,184 malicious skills on ClawHub aimed at stealing sensitive data. The identified threats include…

Matrixport Anticipates Crypto Market Turning Point as Liquidity Drains

Key Takeaways Matrixport notes a surge in Bitcoin’s implied volatility due to a sharp price drop. Bitcoin price…

Bitmine Withdraws 10,000 ETH from Kraken

Key Takeaways A newly created address linked to Bitmine withdrew 10,000 ETH from Kraken. The withdrawal value amounts…

In the face of the Quantum Threat, Bitcoin Core developers have chosen to ignore it

Don't Just Focus on Trading Volume: A Guide to Understanding the "Fake Real Volume" of Perpetual Contracts

Crypto Price Prediction Today 18 February – XRP, Bitcoin, Ethereum

Key Takeaways XRP’s potential as a replacement for SWIFT is bolstered by regulatory approvals, potentially driving its price…

XRP Price Prediction: XRP is Outpacing Solana and Targeting Binance Coin Next – Should You Invest Now?

Key Takeaways XRP Ledger has moved into the sixth place by tokenized real-world asset value, surpassing Solana and…

New AI Predicts the Price of XRP, Dogecoin, and Solana By 2026

Key Takeaways ChatGPT anticipates significant price increases for XRP, Dogecoin, and Solana by the end of 2026. XRP…

Arthur Hayes Shares Two Scenarios for Bitcoin Price, Calling for a Major Crypto Rally

Key Takeaways Arthur Hayes predicts a significant crypto rally fueled by a $572 billion liquidity injection from the…

Bitcoin Price Prediction: Abu Dhabi Gov Funds Buy $1 Billion in BTC – What Do They Know?

Key Takeaways Abu Dhabi has revealed a $1 billion stake in Bitcoin through major ETF investments, signaling strong…

Bitcoin’s Divergence From Nasdaq Signals Dollar Liquidity Risk, Says Arthur Hayes

Key Takeaways Arthur Hayes highlights a concerning divergence between Bitcoin and the Nasdaq, pointing to a potential dollar…

Lagarde’s Possible Early Exit Could Alter Digital Euro Plans and Stablecoin Oversight

Key Takeaways Christine Lagarde’s potential departure as ECB president may disrupt the digital euro timeline and stablecoin policies.…

Bitcoin Experiences Record 23% Decline in Early 2026

Key Takeaways Bitcoin has experienced a record-setting decline of 23% in the first 50 trading days of 2026.…

Whale Holding 105,000 ETH Faces $8.5 Million Loss

Key Takeaways A significant Ethereum holder, often termed a “whale,” has accumulated long positions in 105,000 ETH. The…

Bitcoin Faces Liquidity Challenges as $70,000 Rebound Struggles

Key Takeaways Bitcoin’s attempts to break the $70,000 mark face significant challenges due to weak liquidity and market…

Newly Created Address Withdraws 7,000 ETH from Binance

Key Takeaways A newly created cryptocurrency address withdrew 7,000 ETH from Binance within an hour, totaling $13.55 million.…

Balancer Halts reCLAMM-Linked Liquidity Pools for Security Check

Key Takeaways Balancer has temporarily halted reCLAMM-related liquidity pools due to security concerns. A report from the bug…

Whales Take on Ethereum: Major Profits from Leveraged Short Positions

Key Takeaways Three Ethereum whales are collectively reaping over $24 million in unrealized profits from short positions. The…